Vehicle to Grid EV Charger: How Used EVs Slash Payback

By Gordon Routledge

Sunday 28th September 2025

SHARE IT

The term game changer gets thrown around like confetti, but with vehicle to grid (V2G) it’s deserved, even if it still sounds gloriously bonkers.

Your EV is a battery on wheels. With a compatible car and the right charger, vehicle to grid (V2G) will run your home, support the grid, and might even boil the neighbour’s kettle.

As programmes and approvals land, that parked battery stops loafing and starts earning, time-shifting energy, boosting solar self-use, and getting paid for grid support.

So, why do I think it’s such a big deal? Let’s look at the numbers.

This morning I had a quick search on AutoTrader and found nearly 2,000 used electric vehicles for sale at under £10,000. One example? A 2020 Renault Zoe R135 advertised for £4,999. The seller assures us it was owned by a vicar’s wife, the classic dealer shorthand for “immaculately cared for.”

Except, in this case, it turns out the vicar’s wife must have been a very committed parishioner. In just a few years she’s clocked up 129,000 miles, no doubt ferrying sponge cakes and hymn books to every corner of the county. So yes, the car is “well used.”

But we’re not interested in the mileage. What really matters here is the battery.

When new, this Zoe came with a 52 kWh pack. Let’s be pessimistic and assume years of motorway miles, regular fast charging outside Greggs, and the occasional enthusiastic use of Eco-Off have reduced that to a usable ~43 kWh. Even at that worst-case level, you’re effectively getting ~43 kWh of battery storage for £4,999 — that’s about £116 per kWh.

For context, my own Tesla dropped from around 100 kWh to 95 kWh over five years and 80,000 miles — so that 43 kWh figure is probably a worst-case scenario rather than the norm.

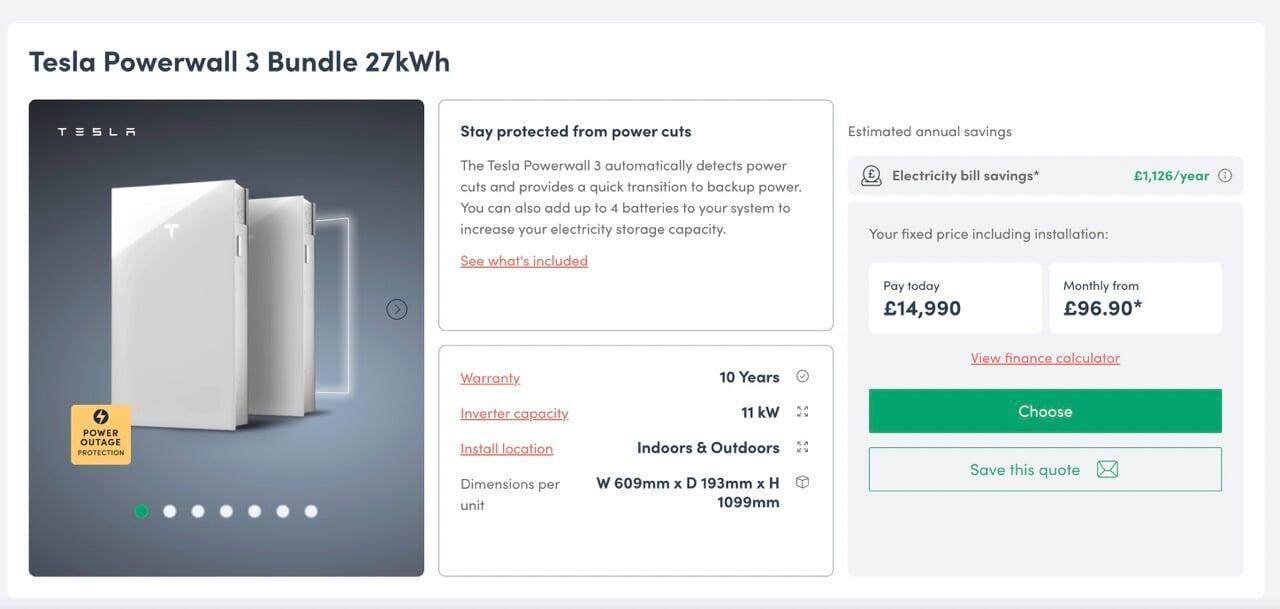

Speaking of Tesla — let’s pit our bargain used EV against Elon’s finest home energy storage solution, the Tesla Powerwall 3. Boxt lists it fully installed at £14,900 for 27 kWh (about £552/kWh). Now let’s walk through a few real-world home energy scenarios and see what the numbers say.

Zaptec Go 2: The Future of EV Charging and V2G Explained!

Vehicle to Grid: How Much Could You Earn?

Scenario 1: Typical UK home.

Think of a household using about 2,700 kWh per year (about 7.4 kWh per day). Assume the EV can charge and discharge at 7 kW on single phase. Charge overnight at 7p/kWh, discharge when power is about 25p/kWh, and allow 5% round-trip loss (delivered cost about 7.37p/kWh). That arbitrage saves about £476 per year if you time-shift the full 2,700 kWh.

Keeping a 30% driving reserve on a 43 kWh used EV leaves a daily swing of 30.1 kWh. After covering the home’s 7.4 kWh per day, you still have about 22.7 kWh per day spare for export — 8,286 kWh per year, worth about £1,461 per year at the same net margin.

Totals: EV about £1,937 per year, giving about 2.6 years simple payback on £4,999.

For comparison, a 27 kWh wall battery (20% reserve gives 21.6 kWh per day swing) leaves about 14.2 kWh per day to export (5,184 kWh per year, about £914 per year). Add the same £476 per year arbitrage and you’re at about £1,390 per year — about 10.7 years payback on £14,900 installed.

Heat-pump home.

Replace the gas boiler with a heat pump and electric use rises to about 6,500 kWh per year (about 17.8 kWh per day). The same tariff shift lifts arbitrage to about £1,146 per year. With the 43 kWh EV and a 30% reserve, you still have about 12.3 kWh per day spare after serving the house — 4,490 kWh per year — worth about £791 per year.

Totals: EV about £1,937 per year, about 2.6 years payback.

Mind peak power as well as energy. Type 2 V2G is connector-limited: 7 kW single phase; 22 kW three phase. In our example the Renault hardware can do about 11 kW on three phase. Fixed batteries have their own continuous-output caps too. When hot-water reheat, the compressor and cooking collide, you may still import for peak power, even if the day’s energy balance is solid.

For the 27 kWh wall battery, there is only about 3.8 kWh per day left for export (1,387 kWh per year, about £244 per year). Add £1,146 per year arbitrage and you get about £1,390 per year, about 10.7 years payback.

Heat pump plus solar.

Add about 3,000 kWh per year of PV and assume most generation is stored for later via the battery with 5% loss. Delivered solar is about 2,850 kWh per year, avoiding about £712.50 per year of imports at 25p. The remaining grid energy is 6,500 − 2,850 = 3,650 kWh; time-shifting that at the established margin (about 17.63p/kWh) adds about £644 per year.

Base benefit (solar self-use plus shifting the remainder): about £1,356 per year.

With the 43 kWh EV (30% reserve), you still have about 12.3 kWh per day headroom for export — 4,490 kWh per year, worth about £612 per year.

Totals: EV about £1,968 per year, about 2.54 years payback on £4,999.

For the 27 kWh wall battery, export headroom falls to about 3.8 kWh per day (1,387 kWh per year, about £189 per year).

Totals: wall battery about £1,545 per year, about 9.70 years payback on £14,900.

Summary:

| Home scenario | Used EV: savings | Used EV: payback | Powerwall 3: savings | Powerwall 3: payback |

|---|---|---|---|---|

| Typical (2,700 kWh/yr, gas) | ~£1,937 | ~2.6 yrs | ~£1,390 | ~10.7 yrs |

| Heat pump installed (6,500 kWh/yr) | ~£1,937 | ~2.6 yrs | ~£1,390 | ~10.7 yrs |

| Heat pump + solar (best) | ~£2,387 | ~2.09 yrs | ~£1,964 | ~7.63 yrs |

| Heat pump + solar (conservative) | ~£1,968 | ~2.54 yrs | ~£1,545 | ~9.70 yrs |

If you want payback this side of the decade, the second-hand EV is the one to back. On these numbers it returns the money in about two to three years once export schemes open up, while the glossy wall box takes eight to eleven.

And it’s still a car. School run? Tip run? Cake run for the vicar’s wife? Unplug and go. Don’t need it this week? Leave it on the drive as a battery with number plates—a slightly scruffy, glorified shed that signs for Amazon and hides the gardening tools. Not the most glamorous look… but when it’s cutting bills and getting paid to support the grid, you'll learn to love it.

Why this actually changes the game

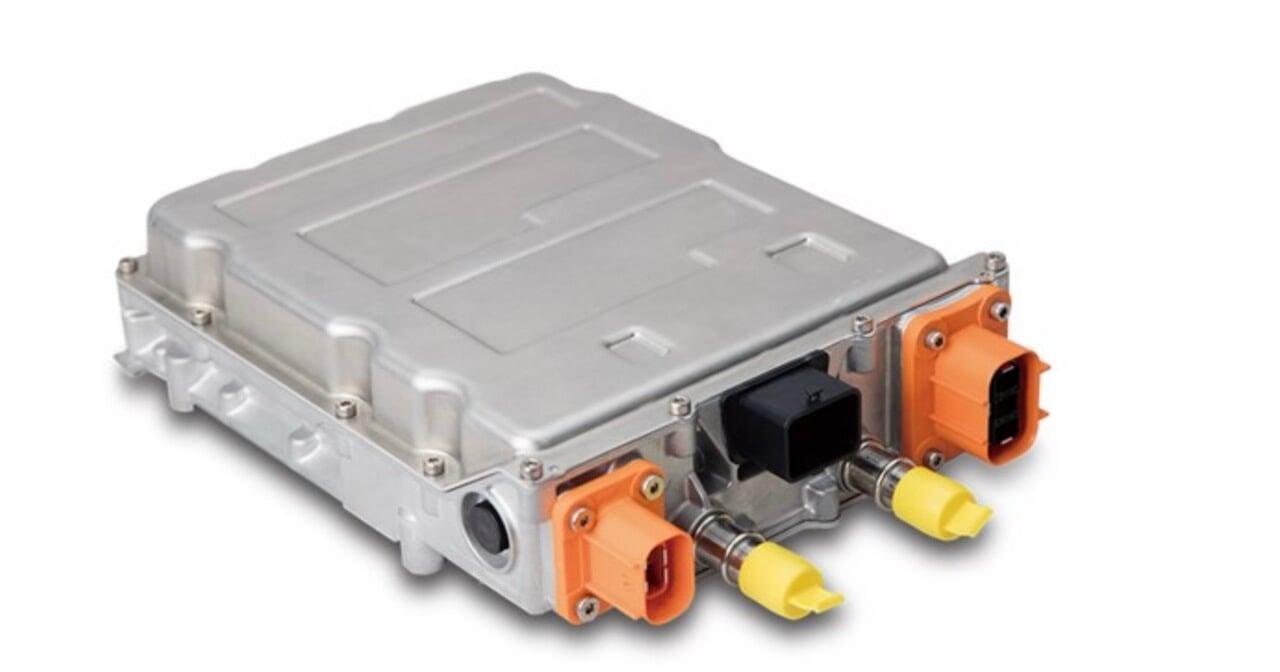

I’ve painted a view of the near future because, to be clear, most second-hand cars on sale today don’t support V2G yet. That switch flips when car makers fit the right kind of on-board charger (OBC), the bit that does the real AC↔DC power conversion inside the car and enable bidirectional operation. The wall unit we call a “charger” is mostly the interface and safety gate; the heavy lifting lives under the bonnet. The comms rulebook for two-way power is already written (ISO 15118-20 covers bidirectional power transfer), and V2G-ready home units are arriving now. Zaptec’s Go 2, for example, is built for ISO 15118-20 and can be enabled by software when the vehicles and market are ready.

Now the scale. In 2024, the UK registered about 381,970 new battery-electric cars. In the same year there were about 184,000 MCS-certified domestic solar PV installs. That’s roughly two EVs for every new solar home.

Give each EV a conservative 50 kWh battery and each solar home a 10 kWh wall battery. One year of cars adds ~19 GWh of potential storage (381,970 × 50 kWh). One year of home batteries alongside those solar installs would add ~1.8 GWh (184,000 × 10 kWh). So cars outnumber solar homes 2:1, but the storage arriving on wheels is nearer 10:1. Broad-brush, yes—but it shows why V2G matters: once approvals and firmware are in place, the driveway becomes the country’s biggest new battery, one parking space at a time.

That’s the point: the tech handshake exists, the boxes are ready, and the fleet is arriving at scale. When the cars ship with bidirectional OBCs and the grid gives the nod, the “vicar’s-wife special” stops being a quaint anecdote and starts being a serious storage asset on your drive.