Do Solar Panels and Battery Storage Increase Home Insurance Costs?

By Gordon Routledge

Monday 2nd February 2026

SHARE IT

They’re on new builds… on bungalows… on farmhouses… probably on your neighbour’s roof, quietly soaking up sunlight while you’re still paying a small fortune just to run the tumble dryer.

And batteries?

Batteries are the new obsession. A sleek box on the wall that promises freedom from the grid, lower bills, and the ability to tell your energy supplier to politely get lost.

So far, so brilliant.

But recently, in passing, we heard something that made us pause. A casual comment from someone in the trade — that solar and battery installs might be nudging up customers’ home insurance. Not enough to cause panic, but enough to make you wonder if this is one of those modern “hidden costs” that only appears after you’ve spent £10,000–£15,000 on a shiny new system.

So, being the sort of people who can’t leave a question alone, we decided to investigate. Properly.

We needed a normal house — not a mansion in Surrey with an indoor pool — just a typical British home. So we picked a semi-detached house in Didsbury, Manchester, currently on the market for around £500,000. Exactly the sort of place that might get a few panels on the roof and a battery in the garage.

Then we did what most homeowners do: we went to the comparison sites. And within seconds, up pops the cheeky little meerkat. The meerkat wants to know everything. Do you work from home? Have you got a side hustle selling scented candles from the spare room? Do you have working smoke alarms? Are the doors locked? Is the dog dangerous?

But here’s the interesting bit: at no point does it ask if you’ve got solar panels. And it certainly doesn’t ask if there’s a lithium battery bolted to a wall somewhere in the house.

Which raises a rather important question. If insurers don’t even ask about solar and batteries upfront, do they actually care? Or do they only care when something goes wrong?

What we did (and why it matters)

We didn’t stop at the quotes.

Because the real “truth” of home insurance isn’t the number you see on the screen. It’s in the policy documents — the long PDFs that can run to 60, 70, even 90 pages of definitions, exclusions, conditions and fine print. They’re full of important stuff you really should read before you buy, but realistically most people don’t… until it’s too late and they need to make a claim.

So here’s what we did. We took 10 home insurance policies offered through the meerkat comparison journey, and we studied the actual policy documentation behind them. Not just the sales summary — the proper wording. We wanted to see whether solar panels are treated as “normal” now, whether battery storage is even mentioned, and what the hidden traps might be around disclosure, workmanship and electrical breakdown.

That’s where it gets interesting.

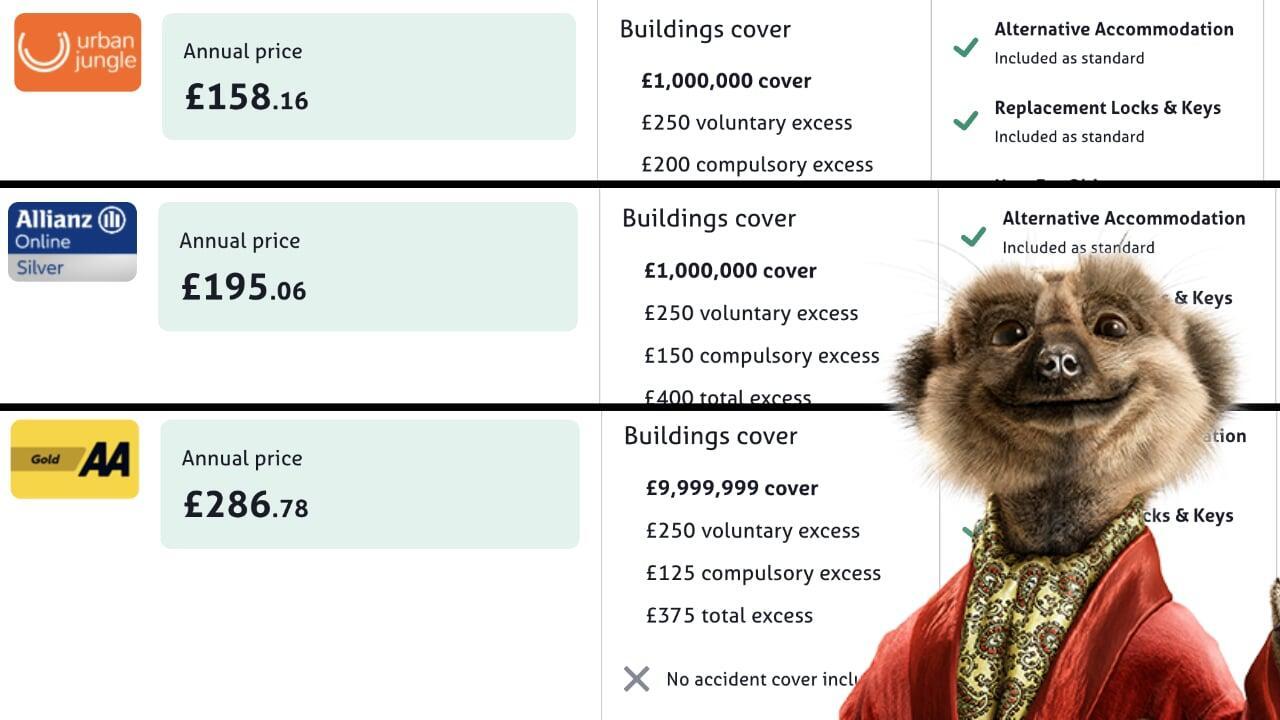

The baseline: insurance prices are already a lottery

Before we even mentioned solar, the first thing we discovered is that home insurance pricing is already all over the place.

For the most basic cover, the quotes we saw ranged from £154 per year up to £347 per year. That’s more than double, for the same house, before solar panels, batteries, heat pumps or anything else even enters the picture. So if solar does affect the premium, it’s happening inside a market that’s wildly variable to begin with.

Does solar increase the rebuild cost? In theory yes… in practice maybe not

One obvious argument is that solar panels — and especially batteries — increase the rebuild cost of a home. After all, you’re adding thousands of pounds’ worth of equipment to the roof and electrics.

When we ran our quotes, the comparison site suggested a rebuild cost of £357,000 for our Didsbury semi. But here’s the key detail: most policies weren’t pricing cover tightly around that figure anyway. Many insurers were automatically including rebuild cover somewhere between £500,000 and £1 million.

So yes, you could argue solar increases rebuild cost. But in this particular case, it made no difference at all — the rebuild limit was already comfortably above what the property would need, panels or not. Which means the premium question probably isn’t being driven by rebuild cost in the way people assume.

So we turned to the policy wording.

What the policy documents reveal: solar is becoming “normal”

After reviewing the policy documents, a clear pattern emerged: solar PV panels are increasingly being treated as a standard part of the building.

Some insurers now explicitly list solar panels in the Buildings definition. Aviva includes “fixed clean energy installations such as solar panels.”

Allianz defines Buildings as including permanently fixed energy installations such as solar panels.

The Post Office goes as far as listing solar panels directly as part of Buildings.

MBNA includes fixed wind turbines and solar panels within the definition of the private residence.

In other words, solar is increasingly being treated like other permanent fixtures. It’s not being positioned as some exotic upgrade that invalidates your cover. It’s just part of the property.

In a few policies, solar panels are also recognised in practical ways beyond the definition. Post Office, for example, explicitly states it will cover repair or replacement of solar panels that are accidentally broken.

That’s a very clear sign that, for at least some insurers, panels have moved firmly into the “normal household risk” category.

The awkward bit: battery storage is still barely defined

Here’s the most striking thing we found across all ten policy documents: battery storage is rarely mentioned in a clear, consistent way.

Even where solar panels are explicitly named and treated as part of Buildings, “home battery storage” often isn’t. That doesn’t mean it’s excluded — but it does mean it’s not neatly categorised in the way solar increasingly is.

And that matters, because batteries tend to be the part insurers are most likely to worry about. Not because a properly installed battery system is automatically dangerous, but because it introduces higher-value electrical equipment, unfamiliar technology, and potential fire severity concerns. If solar is now the normal part of the conversation, battery storage is still the grey area.

The real risk isn’t always the premium — it’s exclusions

When you read the policy documents, you start to see why so many post-installation disputes happen. Because home insurance is not designed to be a warranty for electrical kit.

A common theme across multiple policies is that mechanical and electrical breakdown isn’t covered. MBNA states clearly that it won’t pay claims if anything mechanical or electrical becomes faulty or breaks down.

That’s directly relevant to inverters and battery packs. If something fails internally, that’s typically treated as breakdown, not an insured event — unless that failure causes wider insured damage such as a fire.

Another repeated theme is workmanship. Policies often exclude damage caused by poor workmanship, faulty materials or bad design. Aviva excludes damage caused by faulty materials, design or poor workmanship.

MBNA also excludes bad workmanship or design and the use of faulty materials.

From an electrician’s point of view, this is crucial: insurance generally won’t pick up the tab for problems rooted in installation quality. That sits with the installer, the manufacturer warranty, or ultimately the customer — depending on what went wrong and who’s responsible.

Why insurers expect to be told: solar can be a structural alteration

There’s another reason insurers care — and it’s not just the value of the kit.

Solar panels can alter the structure and risk profile of the building. Roof-mounted PV introduces wind loading considerations. Roof penetrations can change how a roof behaves in storms and heavy weather. And with in-roof systems, you can also be changing the fire performance of the roof structure itself.

So when policies say “tell us about alterations,” it’s not just administrative box-ticking — it can be grounded in real building risk.

The Post Office requires customers to tell them about significant alterations to the home.

Safeguard includes structural alterations, restoration or renovation as changes that must be disclosed, and notes terms or premiums may change as a result.

Aviva also flags that you should tell them if you plan to alter or renovate the buildings.

So while the meerkat might not ask about solar panels, the policy wording often assumes you’ll disclose changes — particularly if the installation materially alters the property.

So… does solar increase home insurance costs?

From what we’ve seen, the honest answer is this: solar panels are increasingly being treated as normal, and any premium effect is hard to isolate because the baseline pricing varies massively anyway.

The bigger story isn’t always the cost. It’s clarity.

Solar is now frequently written into Buildings definitions, and sometimes even into accidental breakage cover. Battery storage, by comparison, is still poorly defined in many policy documents. And across the board, the same exclusions and conditions keep appearing: breakdown isn’t covered, poor workmanship isn’t covered, and significant alterations should be disclosed.

The eFIXX bottom line

If you’re thinking about installing solar and battery storage, don’t assume your insurer “doesn’t care” just because the comparison site didn’t ask. Read the policy wording, or at the very least check the key points: how Buildings is defined, what exclusions apply to electrical breakdown, what it says about workmanship, and what it expects you to disclose.

And if you’re the installer, it’s worth making this part of the customer conversation. Not as a scare story — just as a practical reality.

Because the last thing anyone wants is to discover what the policy really thinks about batteries… after the claim.

SHARE IT

CURRENT THINKING

V2G: The Vicar’s Wife Drove it; Now it Runs Your House.

The term game changer gets thrown around like confetti, but with vehicle to grid (V2G) it’s deserved. Your EV is a battery on wheels. With a compatible car and the right charger, vehicle to grid (V2G) will run your home, support the grid, and might even boil the neighbour’s kettle.